does massachusetts have an estate or inheritance tax

Therefore this tax would not apply. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the exemption threshold.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Call 603 230-5920 M-F 800 AM to 430 PM.

. If youre responsible for the estate of someone who died you may need to file an estate tax return. Massachusetts and Oregon have the lowest exemption levels at 1 million with Connecticut having. If you dont need to make changes to that document it will last you for the rest of.

The minimum amount that an estate can be valued at without being subjected to an. If the estate is worth less than 1000000 you dont need to file a return or. Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. If you are a resident of Massachusetts and you die with more than 1 million in your taxable estate then you owe a Massachusetts estate tax. New Yorks estate tax.

Inheritance tax is based on the laws of the state where the person leaving the inheritance resides at the time of their death. Massachusetts does not have inheritance tax. There is a minimum amount that the estate can be valued at that wont be taxedonce the estates value goes above that amount the entire estate is subject to the tax.

The graduated tax rates are capped at 16. Hawaii and Washington State have the highest estate tax top rates in the nation at 20. Unlike an inheritance tax New York does have an estate tax.

Massachusetts has no inheritance tax. The Legacy and Succession Tax RSA 86 was repealed effective for deaths occurring on or after January 1 2003. Massachusetts and Oregon have the lowest exemption levels at 1 million with Connecticut having.

The top rate in 2020 was 15 percent but a reduction of 40 percent brings the top rate to 9. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated. The Massachusetts taxable estate is 940000 990000 less 50000.

Fortunately Massachusetts does not levy an inheritance tax. Any family estate in Massachusetts worth 1 million can benefit from estate tax planning. DC 56 million 16.

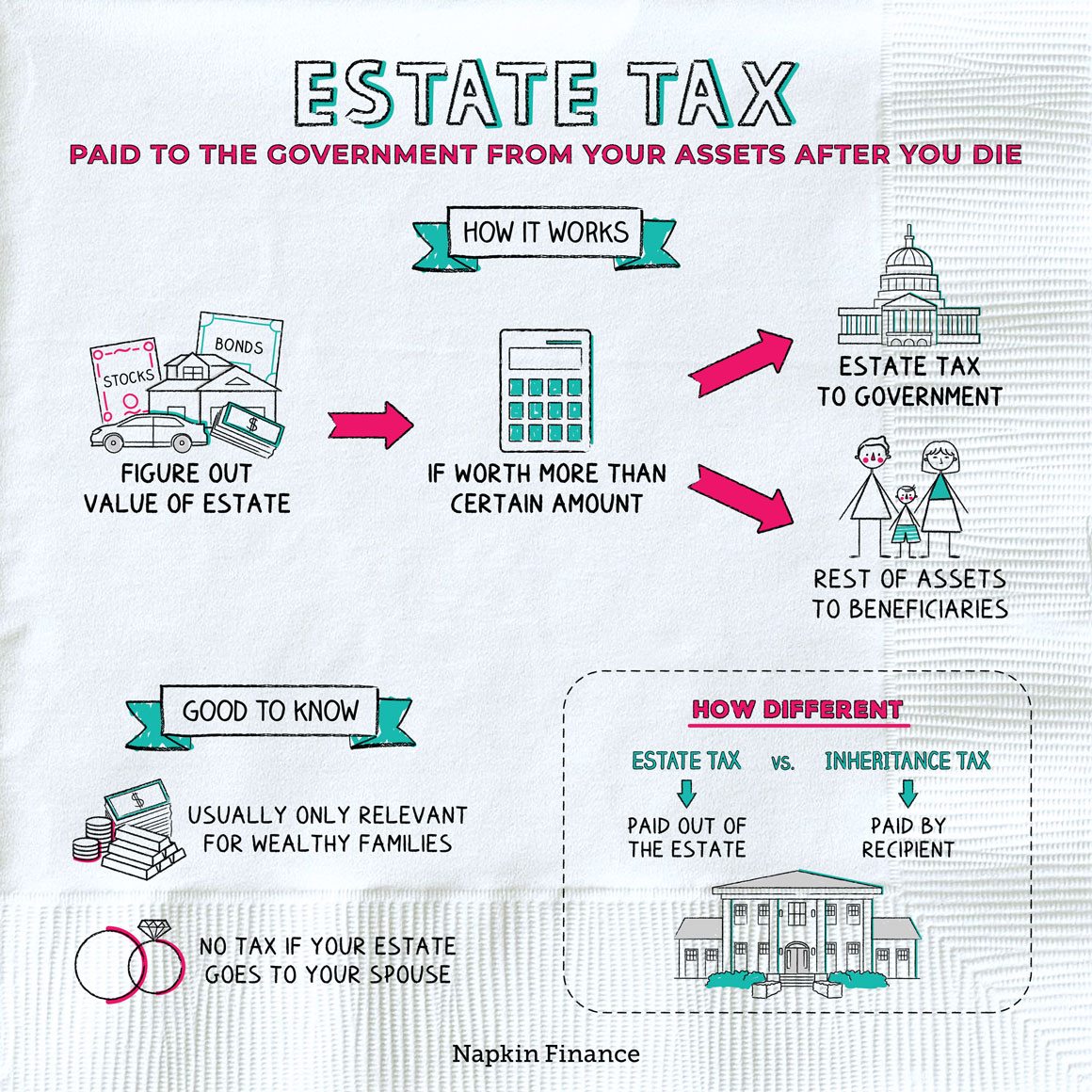

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000. The terms inheritance tax and estate tax are often used interchangeably but they are very different things. Currently 12 states and the District of Columbia have estate taxes and six have an inheritance tax with Maryland having both.

A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both. Other strategies to avoid an estate tax include creating a gifting plan life insurance trusts and qualified personal residence trusts QPRTs. This means that if you inherit money or assets from someone who lived in Massachusetts at the time of their death you will not have to pay taxes on those amounts.

Hawaii and Washington State have the highest estate tax top rates in the nation at 20. Connecticuts estate tax will have a flat rate of 12 percent by 2023. States with Estate Taxes Threshold Rate.

The estate tax is a tax paid by the estate of a deceased person if the taxable assets are worth more than a set threshold amount 1 million in Massachusetts. Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut. This means that if your estate is worth 25 million the tax will apply to the entire 25 million not just the 15 million amount that is above the exemption.

Create Your Legal Will in 20 Mins. Heres where things stand as of this writing. Legacy and Succession Tax.

Massachusetts doesnt have an inheritance tax. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Rates and thresholds vary with both subject to change by state legislatures.

The Massachusetts estate tax uses a graduated rate ranging from 08 to 16 percent. M-F 800 AM to 430 PM. A family trust can have significant savings for Massachusetts couples in this example 200000.

Ad 3995 100 Money Back Guarantee. Connecticut 51 million 72-12. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both.

Five Taxes Your Heirs May Pay Or Not After Your Death Ssb Llc Samuel Sayward Baler Llc Dedham Ma Lawyers

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

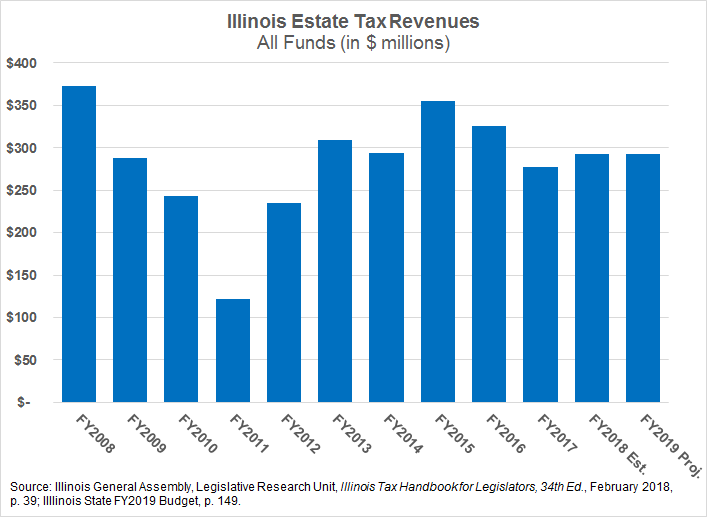

Whither The Illinois Estate Tax The Civic Federation

Jfk Jr S Will Page 2 Jfk Jr Jfk Words

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset

What Is An Estate Tax Napkin Finance

Massachusetts Estate Tax Everything You Need To Know Smartasset

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

Four Reasons We Need Strong Estate Taxes Mass Budget And Policy Center

Tax Foundation Most States Moving Away From Estate Inheritance Taxes Wa Has Nation S Highest Estate Tax Rate Opportunity Washington

A Guide To Estate Taxes Mass Gov

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

How Do State Estate And Inheritance Taxes Work Tax Policy Center