does doordash report income to irs

Dashers should make estimated tax payments each quarter. March 31 -- E-File 1099-K forms with the IRS.

Doordash 1099 Critical Doordash Tax Information For 2022

This is the reported income a Dasher will use to file.

. DoorDash uses Stripe to process their payments and tax returns. DoorDash does not provide a breakdown of your total earnings between base pay tips pay boosts milestones etc. How does Instacart report wages.

January 31 -- Send 1099 form to recipients. You do have the. DoorDash does not take out withholding tax for you.

The forms are filed with the US. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income. Youll receive a 1099-NEC if youve earned at least 600.

They have no obligation to report your earnings of. At the end of every. Log into your checking account every pay day and put at least 25 of your dd earnings in savings.

2 days ago. Each year tax season kicks off with tax forms that show all the important information from the previous year. How does DoorDash report to IRS.

A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. But if filing electronically the deadline is March 31st. If Dashing is a small portion of your income you may be.

Tough to decipher the exact question youre asking but. Internal Revenue Service IRS and if required state tax departments. If youre a Dasher youll need this form to file your taxes.

Does DoorDash issue a 1099. February 28 -- Mail 1099-K forms to the IRS. You do not get quarterly earnings reports from dd.

19 hours agoDoorDash Taxes You Have to Pay Since DoorDash does not withhold your taxable income for you no matter the amount you make you have to report the amount to the IRS. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. Doordash will send you a 1099-NEC form to report income you made working with the company.

The ones you receive are for you to keep in your financial. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation.

You dont have to send your copies of the 1099 forms to the IRS since Instacart already sent one. DoorDash does not automatically withhold.

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

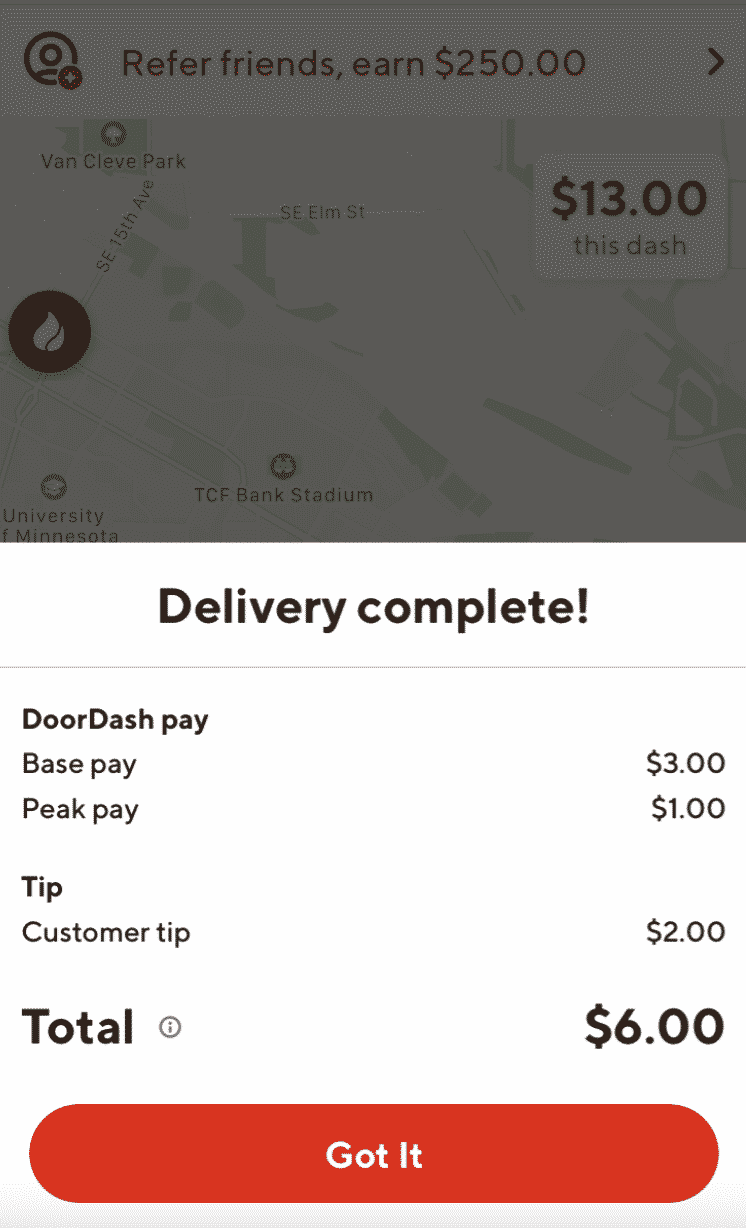

How Much Did I Earn On Doordash Entrecourier

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Doordash Driver Canada Everything You Need To Know To Get Started

How To Do Taxes For Doordash Drivers 2020 Youtube

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Weekly Total For The Week R Doordash

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

How Does The Doordash 1099 Thing With Stripe Work 2022